04 Oct 6 5: Compare and Contrast Variable and Absorption Costing Business LibreTexts

As a result, such costs are allocated to products. However valid the claims are in support of absorption costing, the method does suffer from some deficiencies as it relates to enabling sound management decisions. Absorption costing information may not always provide the best signals about how to price a product, reach conclusions about discontinuing a product, and so forth. Variable costing doesn’t add fixed overhead costs into the price of a product so it can give a clearer picture of costs. These costs are hidden in inventory and don’t appear on the income statement when assigning these fixed costs to the cost of production, as absorption costing does. When variable costing is used, the gross margin reported from a revenue-generating transaction is higher than under an absorption costing system, since no overhead allocation is charged to the sale.

Breaking Down the Income Statement

With variable costing, all variable costs are subtracted from sales to arrive at the contribution margin. Nepal’s presentation divides variable costs into two categories. The variable product costs include all variable manufacturing costs (direct materials, direct labor, and variable manufacturing overhead).

Absorption Costing vs. Variable Costing: What’s the Difference?

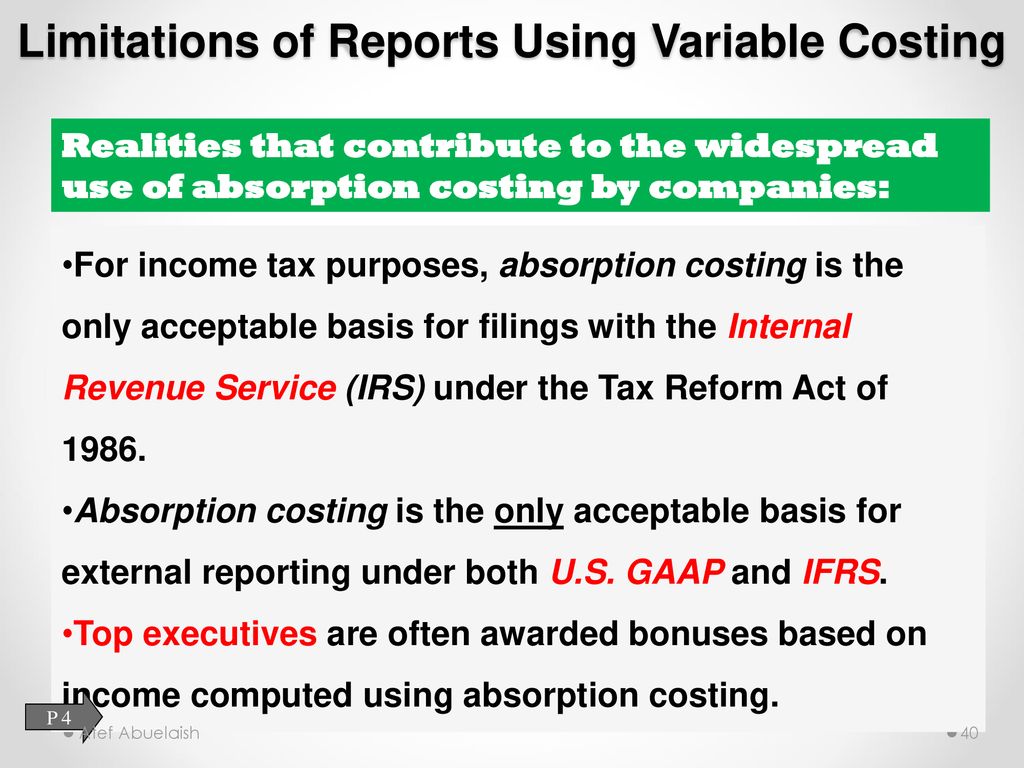

Each decision is intended to be in the best interest of the entity, even when a full costing approach causes the decision to look foolish. Absorption versus variable costing will only be a factor for companies that expense costs of goods sold (COGS) on their income statements. Any company can use both methods for various reasons but public companies are required to use absorption costing due to their GAAP accounting obligations. The variable cost per unit is \(\$22\) (the total of direct material, direct labor, and variable overhead).

- It gives you a clearer picture of how changes in production affect your profits.

- Any accountant handling financial reports and information for these companies must adhere to GAAP guidelines.

- The U.S. Securities and Exchange Commission (SEC) and GAAP are primarily concerned with external reporting.

- For example, if a fixed cost of $1,000 is allocated to 500 units, the cost is $2 per unit.

- By staying informed about these trends and continuously evaluating their costing methods, businesses can ensure they remain competitive and compliant with evolving accounting standards.

Absorbing Costs through Overproduction

When the product is sold, its cost is then expensed off as cost of goods sold on the income statement. Under absorption costing, fixed factory overhead is allocated to the finished goods inventory account and is expensed to cost of goods sold when the product is sold. To recap, the variable costing income cost variance formula and analysis how to calculate cost variance video and lesson transcript statement is different from the absorption costing income statement in several ways. (1) Only variable production costs are included in cost of goods sold. (3) Variable selling and administrative expenses are grouped with variable production costs as part of the calculation of contribution margin.

The IFRS Foundation is responsible for overseeing, maintaining and updating the accounting standards in each of these countries. Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures. Direct labor hours is an example of an activity measure. This usage measure can be divided into the cost pools, creating a cost rate per unit of activity. You’re in the hot seat, making choices that’ll shape your company’s future.

Companies will likely show a lower gross profit margin. The variable direct costs and fixed direct costs are subtracted from revenue to arrive at the gross profit in either case. Absorption costing is also known as full costing. Public companies are required to use the absorption costing method in cost accounting management for their COGS.

(4) Contribution margin is listed after deducting all variable costs from sales. (5) Fixed production costs are shown below the contribution margin on the income statement with fixed operating costs. Selecting the appropriate costing method is crucial for accurate financial reporting and effective cost management.

It’s about painting the whole financial picture, not just part of it. Sometimes it overshoots, sometimes it undershoots. Cost accounting isn’t just about crunching numbers. It’s a strategic game of assigning costs where they belong. Let’s peek behind the curtain and see what’s really going on.