08 Feb Accounts Receivable Process Step-by-step AR Process Guide

This way their customers will be happy as they can receive goods without the need to pay the money today. Before deciding whether or not to hire a collector, contact the customer and give them one last chance to make their payment. Collection agencies often take a huge cut of the collectible amount—sometimes as much as 50 percent—and are usually only worth hiring to recover large unpaid bills. Coming to some kind of agreement with the customer is almost always the less time-consuming, less expensive option.

Document your process

- Firms that are typically paid over a period of months will have a larger amount of receivables in the 60-day category.

- A typical ageing schedule will group outstanding invoices based on 0 to 30 days, 30 to 60 days, etc.

- The goal is to increase the numerator (credit sales), while minimising the denominator (accounts receivable).

- Usually the longer the overdue the more likely that the customers are not going to pay back the money.

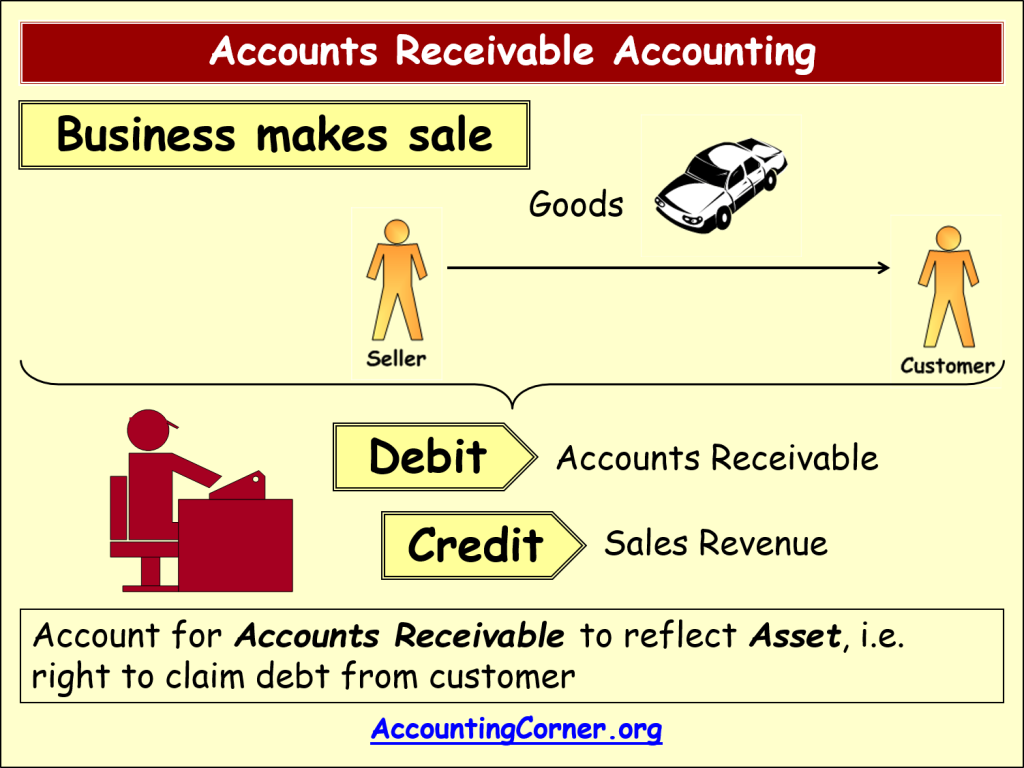

Let’s consider the above example again to understand what is accounts receivable and the journal entry for accounts receivable. Lewis Publishers purchases this quantity of paper on credit from Ace Paper Mill. In such a case, Ace Paper Mill invoices Lewis for $200,000 (10,000 tons x $20 per ton) and gives Lewis Publishers a Credit Period of 45 days to pay the amount. Thank you for reading this guide to Accounts Receivable (AR) and how it impacts a company’s cash flow. CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

Automated accounts receivable at Invoiced

Most department stores like JCPenny and Macy’s have their own credit cards, but smaller retailers are also starting to develop these programs as well. Once your customers agree to pay you back later, you have to make sure they actually follow through with that promise. When a customer agrees to pay for something on credit, you can run a credit check to determine if they’re credit-worthy. You can also have them sign an agreement promising they will pay you back if they purchase something on credit. To help financial statement users make other decisions, GAAP call for other disclosures regarding receivables. Receivables that are expected to be collected within 12 months of the operating cycle are classified as current.

Step 1 of 3

It’s an asset because it has value, and it’s a current asset because it’s expected to be collected within the next 12 months. A good accounting system with tools for managing invoice accounts receivable can help you get paid faster, so you can focus on running your business. For example, businesses that collect payments over a period of months may have a larger dollar amount of receivables in the older categories.

Disputes can still delay payment and cause cash flow issues for your business. It’s generally considered best practice to send invoices immediately after goods or services have been rendered. It also begins the payment terms outlined in the sales order, which encourages the customer to pay more quickly.

What Is Accounts Receivable?

This allowance is subtracted from the gross receivables of your business to determine the net realizable value of accounts receivables. The allowance for doubtful accounts is the estimate of accounts receivable not expected to be paid by the customers for goods sold on credit to them. Typically, businesses sell goods on credit only to creditworthy customers, but good accounting practice requires you to keep some amount for accounts receivable that may not be paid. The easiest way to handle bad debts is to use the direct write-off method. When you know that a bill will not be paid, you reclassify the receivable balance to bad debt expense.

Accounts receivable is one of the most important line items on a company’s balance sheet. It reflects the money owed to a company from the sale of its goods or services that remains to be paid by the buyer. Even though it is not yet in hand, unemployment it is considered an asset because the company expects to receive it in due course. The shorter the period of time a company has accounts receivable balances, the better, as it means the company can use that money for other business purposes.

The credit is to the allowance for bad debts account, which is a reserve account that appears in the balance sheet. Later, when a specific invoice is clearly identifiable as a bad debt, the accountant can eliminate the account receivable with a credit, and reduce the reserve with a debit. Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. Unless you require advanced payments or deal with cash on delivery (COD) sales only, you must record these credit-based transactions as A/R within your general ledger and corporate balance sheet.