21 Oct InvestorQ : How do ETFs compare with other classes of mutual funds that are currently available in the markets?

Contents

Keep an eye on the gold price trends before you start transacting. Just like with stocks, you may want to buy gold ETFs at low prices and sell them as prices go up. Since gold ETFs come with brokerage or commission charges of 0.5 to 1 percent, shop around the ETF market a bit to find a stockbroker/fund manager whose charges are low.

- You are advised to read the respective offer documents carefully for more details on risk factors, terms and conditions before making any investment decision in any scheme or products or securities or loan product.

- ETFs have made an abundance of new portfolio construction open doors for a wide scope of investors by opening up new resource classes for contributing.

- Some of them are also employed as a form of inflation protection.

- You will be able to sell your units only if you find a suitable counterparty.

Almost all investors will be able to find an ETF that meets their needs. Check your securities/MF/bonds in the consolidated account statement issued by NSDL/CDSL every month. Hence, the only way the value of an ETF will become nil is if the value of each of the underlying security becomes zero.

But in order to make the most of them, you have to have a firm understanding of exactly how ETFs can help you achieve your objectives. Easy transactions – You can buy and sell gold ETFs at any time of the day when the stock exchanges are open from any part of the country. You will also not be affected by local price differences in gold due to VAT or other taxes. Create a simple and uncomplicated Portfolio of ETF’s tracking the Index and Gold and if you are a little more adventurous add some ETF from Banks too. Create a systematic investment plan on these ETF to stagger you investments. With investment in just these 3 ETF’s you would effectively have created a well-diversified portfolio of more than 70 top stocks in the market.

ETF Stock: Understanding Stocks ETFs

With ETFs, the exchange is perfect and basic when exchanging investment firms. They are considered a convenient investment, which offers a decent favorable position over mutual funds. Whereas the daily trading volume of HDFC Nifty exchange traded fund is 1,016 shares.

How do I invest in an ETF?

- Open a brokerage account. You'll need a brokerage account to buy and sell securities like ETFs.

- Find and compare ETFs with screening tools. Now that you have your brokerage account, it's time to decide what ETFs to buy.

- Place the trade.

- Sit back and relax.

Some of the common benchmark indices include the BSE Sensex, Nifty 50, S&P BSE Banks, etc. The purpose of an investment is the most basic and important aspect to factor in. It is easier to pick the right ETF when you have firm & clear objective behind investing. Some ETFs produce above average returns in the long haul while some are suitable for short run only.

Some of the features of investing through an ETF :

Some sector ETFs currently in India are RShares Dividend Opportunities ETF, RShares Consumption ETF. Mutual funds give each investor access to professionally manage portfolios of equities, bonds, and other securities. Therefore, each shareholder participates proportionally in the profit or losses of the fund.

The beauty of asset-specific factors is that it can be diversified away. The goal of an ETF is to track the performance of the underlying benchmark. The tracking error is a measure that looks at the deviation of ETF returns from the benchmark returns.

Additionally, large investors can sell ETFs units through a process called “in-kind” redemption. In this, the large investors deposit the ETF units to the sponsor of the ETF fund. The sponsor, in turn, returns the shares that constitute the underlying. ETFs are an investment medium which combine the features of mutual fund & stock investing. On one hand, investors can buy an ETF with an aim to get underlying Index returns at relatively low cost and on the other hand they can trade in an ETF like a stock at live NAV, to benefit from intra-day volatility, if desired. Exchange Traded funds or simply know as ETFs are a type of Mutual Funds that aims to provide returns similar to the index it is tracking, by investing in the basket of securities which are part of the underlying index.

Exchange-Traded Fund or ETF is an investment fund that is traded on the stock exchange. The securities held under an ETF are commodities, stocks, and bonds. These are traded for The securities held under an ETF are commodities, stocks, and bonds. These are traded for an amount close to the original total asset value of the asset, during the trading day.

We currently offer over 70 ETFs on our platform, carefully selected to give you a wide exposure to the most common investing strategies or specific themes/sectors. Exchange Traded Funds are getting increasingly popular, as historical data suggests that on average passively managed index funds have been outperforming actively managed funds. By shorting equities, inverse ETFs try to profit from stock falls. Shorting is the act of selling stock and then repurchasing it at a cheaper price, anticipating a price drop.

Buying ETF units

Like a common fund, a financial specialist purchases shares in an ETF to possess a proportional interest in the pooled assets. When buying shares, investors study the fundamentals of the company. They might conduct top-down or bottom-up investment approach to selecting stocks. Whereas in mutual funds, investors pass this responsibility to the fund managers.

Selecting the right ETF in accordance with your risk appetite and investment goals is very important to reap benefits. If you can’t explain the investment opportunity in a few words and in a way that everyone can comprehend, you might want to reconsider making the investment. ETFs have several drawbacks that you should be aware of before investing in an ETF trading firm. Stock ETFs are a collection of stocks that track a specific industry or sector. A stock ETF might, for example, track automotive or international stocks.

Her strength lies in simplifying complex financial concepts with real life stories and analogies. Her goal is to make common retail investors financially smart and independent. Considering the share price as on 30th September 2021, you will have to shell out Rs 1,53,678. broker review If you are subscribing to an IPO, there is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account.

Exchange Traded Funds Vs Mutual Funds

MFs are actively managed by fund managers or professionals, while ETFs are passive investment options that track the performance of an index or broader class of instruments. Hedge Funds are not registered and are open to qualified Definition Of Cross Platform investors only. The main difference between an ETF, a MF and a Hedge Fund is that while ETFs can be actively bought and sold on the exchanges, just like any other shares, one can only purchase a unit of a MF from a fund house.

What is ETF creation & redemption?

Ans: ETF creation is the wrapping up of all underlying securities into one exchange-traded fund structure. While redemption is unwrapping an ETF into individual securities.

ABCL and ABC Companies are engaged in a broad spectrum of activities in the financial services sectors. Any recommendation or reference of schemes of ABSLMF if any made or referred on the Website, the same is based on the standard evaluation and selection process, which would apply uniformly for all mutual fund schemes. Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website. Diversification is another significant benefit that an investor derives from ETF investments. One can potentially choose from a wide range of ETFs, which mainly differ based on the underlying asset such as gold, equity or index funds. Equity, as an asset class, is an attractive investment avenue for investors with high-risk appetite and a long-term investment horizon.

In this case, trading volume of underlying securities as well as of the entire ETF basket affect fund’s liquidity. Although cost effectiveness is one of the advantages ETFs over mutual funds, all ETFs are not uniformly charged. However, marginal the difference, it’s better to take everything from trading fees to operating commission into consideration. FundsIndia offers FREE Financial Partner services to all customers. Depending on an individual’s financial needs, our mutual fund and equity experts offer objective, prudent and unbiased advice to help achieve goals.

The buy and sell of ETF is simple, and many can take the advantage of intra-day price movements. Another advantage noticed is by just purchasing 1 unit of ETF, you get an exposure towards an entire index at a lower rate. One can seek the benefit of flexibility towards stocks and diversification of an open ended mutual fund scheme.

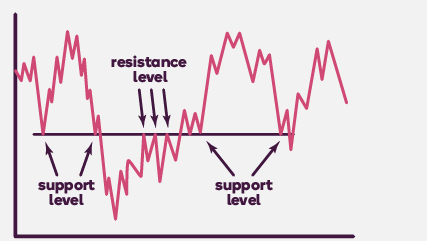

Investors have to select ETFs that have higher liquidity and trade volume, which ensures higher profitability or return on investment. While tracking liquidity, the investor has to ensure the liquidity of the shares being tracked and the fund. Monitoring liquidity assures the investor to exit the fund whenever they want, especially at the time of market declines. An efficient ETF has market markers that track the buying and selling to ensure sufficient liquidity of the fund at all times.

Individuals can buy and sell ETFs on stock exchanges via a broker. Under passive equity, ETFs have outgrown index funds by a landslide over the Wpf Dynamically Setting Number Of Rows past five years. ETFs took off when the Government kicked off their disinvestment programs in 2015 using ETFs as the chosen investment vehicle.