19 Jan LIFO Reserve: Guide to Accurate Inventory Valuation

Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Browse our Private Company Perspectives collection for insights and evolving trends for private when are 2019 tax returns due companies. For instance, the current ratio is the most used and popular ratio to assess a company’s liquidity. The inventory goes out of stock in the same pattern in the FIFO method as it comes in.

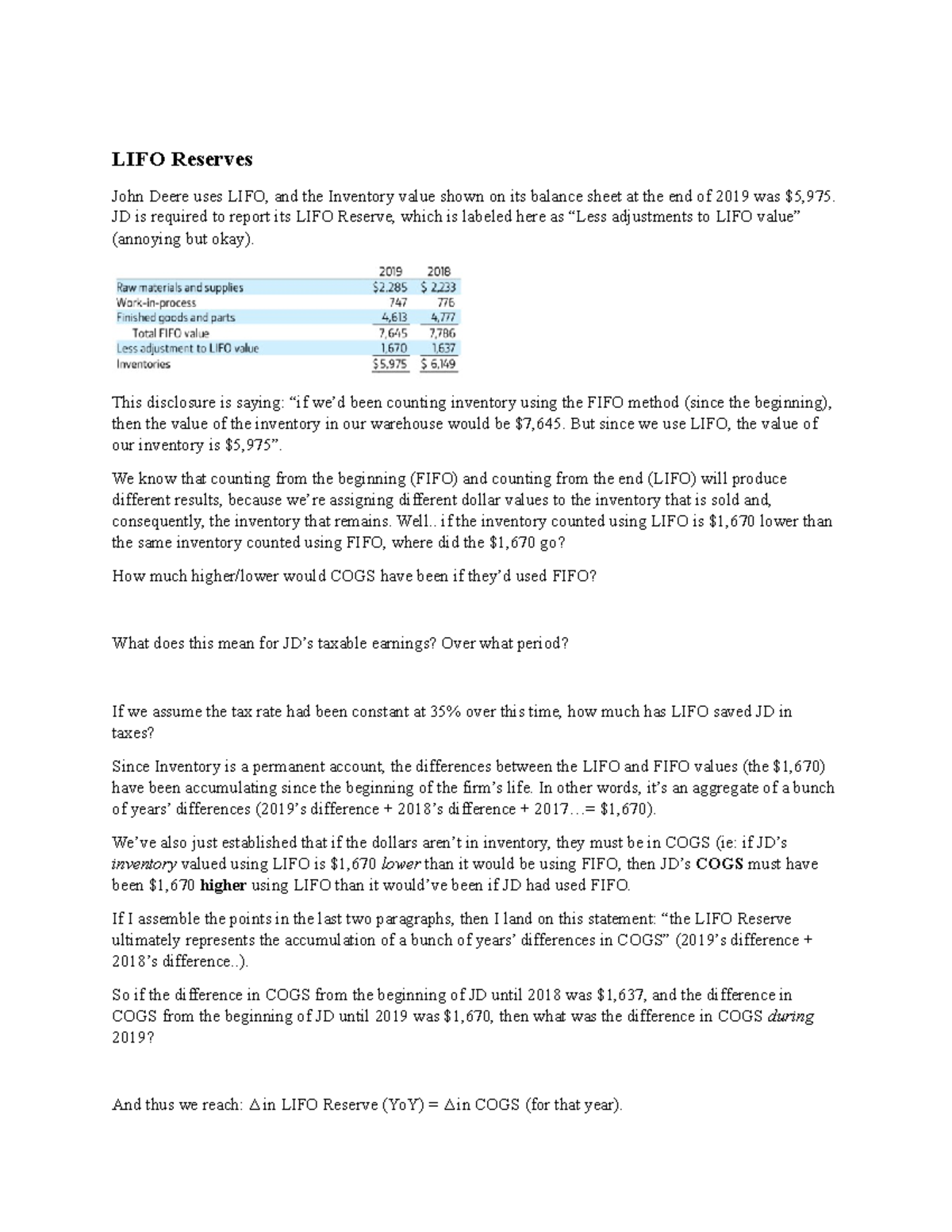

How to Calculate the LIFO Reserve

Given the complex LIFO inventory calculations involved, most companies use accounting software or Excel templates to determine LIFO reserves. The use of this account must be disclosed in the financial statement footnotes, so investors and other external users can appropriately compare metrics. Based on the example above, the difference between the two different inventory values would be $5 ($30 – $25). This $5 difference is recorded in a contra inventory account that reduces the recorded cost of the inventory. The entire LIFO reserve concept disappears if a business uses a weighted-average method to recognize the cost of its inventory, since that approach (as the name implies) uses cost averaging, rather than cost layering, to determine the cost of an inventory.

LIFO Reserve Journal Entry

If the company reports inventory with the LIFO method, the COGS will be higher, and the gross profit will be low. In this way, the company will have to pay low taxes than what they would have to pay by using the FIFO method. Now let us look at some of the important LIFO reserve adjustment that are to be made in the financial statements, namely the income statement and the balance sheet so that they reflect the true and correct value of inventory levels. This is very impoortnat form the management point of view as well as investor or other stakeholder point of view. The constant increase in cost can create a credit balance in the LIFO reserve, which results in reduced inventory costs when reported on the balance sheet. Moreover, understanding LIFO accounting can help shareholders assess the realizable value of inventory assets reported on the balance sheet and potential tax implications from inventory liquidations.

Formula

- Hence, when comparing two companies – Company A, which follows the LIFO method of Inventory, and Company B, which follows the FIFO method of Inventory, the financial performance and ratios of the two companies become incomparable.

- Under LIFO, the company values its inventory using the most recent costs, which are higher.

- Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

- As a result, a reserve of the difference between LIFO inventory cost and non-LIFO inventory cost.

- Nimble private companies have the ability to adjust their strategies quickly and can take advantage of the opportunities that exist in the current economic environment.

- Now let us look at some of the important LIFO reserve adjustment that are to be made in the financial statements, namely the income statement and the balance sheet so that they reflect the true and correct value of inventory levels.

In these circumstances, to reduce the First In First Out value of inventory to the Last In First Out value, the Last In First Out reserve needs to be a credit entry. This credit balance is then offset against the FIFO inventory valuation resulting in a net balance representing the LIFO valuation. Consequently the Last In First Out reserve account is used as a contra inventory account or more generally a contra asset account.

Find the talent you need to grow your business

With this data, you can compute the value of ending inventory under LIFO (last units purchased are first sold) and FIFO (first units purchased are first sold). The key takeaway is that subtracting the LIFO reserve gives you the FIFO inventory number for comparison purposes. It reverses the ongoing cumulative difference caused by using LIFO rather than FIFO for inventory reporting valuation.

Overall, clear communication of all inventory accounting policies, including LIFO reserves, contributes to more informed analysis. Although the choice of LIFO over any other method does not affect the cash flow related to sales, it affects the cost of goods sold. The LIFO liquidation’s effect on the cost of goods sold would affect gross income, which affects income tax, which in turn affects the operating cash flow. In other words, it quantifies the amount by which a company’s reported assets would be higher if it used FIFO instead of LIFO. From this example, we can see a big difference between the two types of inventory methods. Under LIFO, the company values its inventory using the most recent costs, which are higher.

LIFO reserve is the difference between the carrying amount of a company’s inventories under the first-in first-out (FIFO) method and under the last-in first-out (LIFO) method. LIFO reserve is disclosed by companies that follow LIFO method in accounting for its inventories in order to facilitate the users of financial statements to compare it with companies that might be using FIFO method. We can do some adjustments in the accounting equation to reflect the FIFO Inventory costing in the financial statements of the company using LIFO for external uses. The disclosure of the LIFO reserve allows readers to better compare the financial statements of a company using LIFO with the financial statements of a company using FIFO.

However, it is not a sustainable boost to profits if inventory levels are not maintained. Companies should closely monitor changes in LIFO reserves as an indicator of inventory and cost management practices over time. Usually, a declining LIFO reserve indicates LIFO liquidation, which happens when a company sells more inventory than it purchases during inflationary periods. This reduces the cost of goods sold, thereby increasing profits in the short term. The LIFO reserve is calculated as the difference between the value of inventory under the LIFO (Last In, First Out) and FIFO (First In, First Out) accounting methods. The LIFO reserve represents the difference between the value of inventory reported under the LIFO method and the value that would have been reported under the FIFO method.