06 Apr Stock Chart Patterns for Day Traders 7 Charts to Master

Contents

A price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

We could make a buy trade after the instrument consolidated above the resistance level. The price move is equal to the height of the side channel between the support and resistance levels. The appearance of triangle patterns in the chart makes it difficult to predict the price movement, since there are three types of this pattern. There are many different day trading patterns used in intraday trading on Forex. In the stock market, volume is essential, but we need to be aware of the time of day. This hammer pattern shoed up just before 1500 EST – one hour before the market close.

A double bottom chart pattern indicates a period of selling, causing an asset’s price to drop below a level of support. It will then rise to infinox review a level of resistance, before dropping again. Finally, the trend will reverse and begin an upward motion as the market becomes more bullish.

Weaknesses of the Reversal Pattern

Looking at the beginning of the chart, we can see a uniform increase in price—the important thing here is that it has to be in tandem with an increase in trading volume. If both elements are present, you might be looking at the beginning of a cup and handle pattern. Right off the bat, you can see that the stock’s price experiences a couple of small highs—these peaks are connected to form a small resistance line.

As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole. Ross Cameron’s experience with trading is not typical, nor is the experience of traders featured in testimonials. Becoming an experienced trader takes hard work, dedication and a significant amount of time.

You attempt to buy at the low of the day and sell at the high of the day. Here, the price target is simply at the next sign of a reversal.MomentumThis strategy usually involves trading on news releases or finding strong trending moves supported by high volume. One type of momentum trader will buy on news releases and ride a trend until it exhibits signs of reversal. An ascending triangle is a continuation pattern marking a trend with a specific entry point, profit target, and stop loss level. The resistance line intersects the breakout line, pointing out the entry point.

Our online trading platform is also available on mobile and tablet devices, thanks to advancements in technology. Read more about our mobile trading applications and how you can browse stock chart patterns through our app when trading on-the-go. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend.

Falling Wedge

The small lows, on the other hand, form a diagonal trend line that is trending upward. Once you’re familiar with technical analysis, you’ll see that certain patterns are common. Spotting them requires a basic knowledge of how to read a stock chart, but you’re going to need an in-depth understanding of the patterns themselves to truly make use of them.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Chris Douthit, MBA, CSPO, is a former professional trader for Goldman Sachs and the founder of OptionStrategiesInsider.com. His work, market predictions, and options strategies approach has been featured on NASDAQ, Seeking Alpha, Marketplace, and Hackernoon. Some patterns are more suited to a volatile market, while others are less so.

But Japanese candlesticks, when used correctly, can be a powerful tool in your trading toolbox. SpeedTrader provides information about, or links to websites of, third party providers of research, tools and information that may be of interest or use to the reader. SpeedTrader receives compensation from some of these third parties for placement of hyperlinks, and/or in connection with customers’ use of the third party’s services. SpeedTrader does not supervise the third parties, and does not prepare, verify or endorse the information or services they provide. SpeedTrader is not responsible for the products, services and policies of any third party. Day trading is subject to significant risks and is not suitable for all investors.

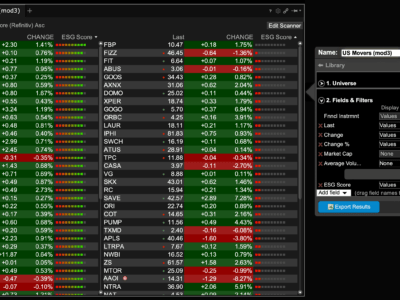

Check Our Daily Updated Short List

Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts. Bar none, the best way to practice using day trading chart patterns is to make use of a demo account—a practice account that allows you to make trades using fake, virtual money.

- The volume is, technically, higher than the past 20-period average and higher than the prior candlestick, but we can see it fall from then on.

- His work, market predictions, and options strategies approach has been featured on NASDAQ, Seeking Alpha, Marketplace, and Hackernoon.

- However, they make more on their winners than they lose on their losers.

- As part of the trading strategy, the target for the instrument was at the distance from the beginning of the downtrend to the beginning of the first upward correction.

There are no fast and easy solutions in the world of investing—but if you take the time to carefully study these patterns, you’ll have a huge leg up on the competition. If you really apply yourself and get acquainted with all of them, you’ll always have at least some idea of what an asset’s price is going to do. The bear flag helps you determine the right time to enter a short position as well as the stop loss and expected profit. When trading intraday, it is important to monitor the price movement, since a particular instrument is also affected by the news background. Any factor in the world can radically change the direction of the price.

Strengths of the Late Day Consolidation Pattern

The cup and handle is a bullish continuation pattern where an upward trend has paused but will continue when the pattern is confirmed. The “cup” portion of the pattern should be a “U” shape that resembles the rounding of a bowl rather than a “V” shape with equal highs on both sides of the cup. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn.

This could be a trend line that started from early in the day or preferably a previous trading day. You are entering trades later in the day and there is a risk for volatility to dry up after the first hour of trading. I have never figured out how to master the reversal chart pattern in full disclosure. It may be something in my brain, where I need things to continue on their current trajectory. Since the entry point is predicated on a breakout, you could find yourself in a bear or bull trap; stops are critical if you want to obtain long-term success.

The trend line signifies the overall uptrend of the pattern, while the horizontal line indicates the historic level of resistance for that particular asset. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions. Once an asset’s price falls enough, buyers might buy back into the market because the price is now more acceptable – creating a level of support where supply and demand begin to equal out.

Day Trading Charts and Patterns

But the more interesting thing happens when one of these two methods gives us a signal that goes counter to what the other one is saying. A double bottom is a reversal pattern—it tells us that the trend that we’ve been seeing is about to end. A double bottom is one of the easiest patterns to spot—it looks like the letter W—or the opposite of a double top. In the case of the double bottom, it tells us that the stock is about to experience an uptrend or an increase in price. A double top is a reversal pattern that signals the beginning of a bearish trend—in other words, a downtrend. It’s easy to spot, and usually signals the beginning of a trend that will last for some time.

The two continuation patterns used most by day traders are the flag and the pennant. The pennant pattern is similar to a symmetrical triangle; the flag pattern is similar to a rectangle. Once a trader grasps the understanding of these patterns, it may lead them to better results. Chart patterns can sometimes be quite https://forexarena.net/ difficult to identify on trading charts when you’re a beginner and even when you’re a professional trader. You can also apply stock chart patterns manually on your trading charts as part of our drawing tools collection. The last of the day trading patterns we’re covering in this post is the head and shoulders.

Finally, there is a symmetrical triangle, which has an equal rising and falling line. When this pattern happens, there is usually uncertainty about the direction that the breakout will happen. There are many other chart patterns you can track in Tradervue, but mastering these five with consistent practice should result in an improvement of your performance. As seen in the image below, there is a steady increase in both price and volume.

While they offer no guarantee of profits—then again, nothing does, using them in conjunction with other analysis tools will help you make reasonable predictions on where prices are going. Be sure to set a price target and stop loss for every scenario, and keep practicing your ability to correctly identify day trading candlesticks patterns. In this fifteen-minute EURUSD chart you can see an example of the developing cup and handle pattern. In the current situation, it was possible to open a trade after the pattern was completely formed and the broken resistance level was retested. The picture shows that the resistance level became a support level, and a bullish hammer candlestick pattern has formed above it. The price movement is calculated from the bottom of the cup to the resistance level or higher.

Taking advantage of small price moves can be a lucrative game if it is played correctly. Yet, it can be dangerous for beginners and anyone else who doesn’t adhere to a well-thought-out strategy. An uptrend interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in fx choice broker review a downtrend. Conversely, a downtrend that results in a head and shoulders bottom will likely experience a trend reversal to the upside. Symmetrical triangles occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—there is no upward or downward trend.

The second bullish signal is when the Composite Index line crosses above the slow average (orange moving average, #2). The volume will typically drop before the breakout of a triangle. The drop in volume is your ‘heads up’ that a move is about to happen. The lack of bearish divergence continues to the conservative entry at #3, letting us know the entry is more than likely safe from any near term downside movement.

Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. The flag stock chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. The following stock chart patterns are the most recognisable and common chart patterns to look out for when using technical analysis to trade the financial markets.

The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern – which is explained in the next section. Day trading patterns are based on empirical evidence of traders. Research papers mostly deny the long-term effectiveness of chart patterns as the expected value of these patterns is less than 0.5. However, trading with chart patterns combined with a deep understanding of price movements may be resultative. A wedge pattern represents a tightening price movement between the support and resistance lines, this can be either a rising wedge or a falling wedge. Unlike the triangle, the wedge doesn’t have a horizontal trend line and is characterised by either two upward trend lines or two downward trend lines.

This list of 17 chart patterns are essential, and knowing them will give an investor a trading edge, so it pays to keep these close. Looking for these chart patterns every day, studying the charts will allow the trader to learn and recognize technical trading strategies in the data and the implications that these patterns imply. Over time, individual candlesticks form patterns that traders can use to recognize major support and resistance levels. There are many candlestick patterns that indicate opportunities in the market. Some indicate the balance between buying and selling pressure, while others identify continuation patterns or market indecision.